UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ý☑ Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

|

| | | | | | | | | | | | | |

¨☐ | | Preliminary Proxy Statement |

¨☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý☑ | | Definitive Proxy Statement |

¨☐ | | Definitive Additional Materials |

¨☐ | | Soliciting Material Pursuant to §240.14a-12 |

lululemon athletica inc. |

(Name of Registrant as Specified In Its Charter) |

|

lululemon athletica inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý☑ | | No fee required |

¨☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1(1) | ) | | Title of each class of securities to which transaction applies: |

| | (2(2) | ) | | Aggregate number of securities to which transaction applies: |

| | (3(3) | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4(4) | ) | | Proposed maximum aggregate value of transaction: |

| | (5(5) | ) | | Total fee paid: |

¨☐ | | Fee paid previously with preliminary materials. |

¨☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1(1) | ) | | Amount Previously Paid: |

| | (2(2) | ) | | Form, Schedule or Registration Statement No.: |

| | (3(3) | ) | | Filing Party: |

| | (4(4) | ) | | Date Filed: |

TABLE OF CONTENTS

TO OUR STOCKHOLDERS:SHAREHOLDERS:

We are pleased to invite you to attend the annual meeting of stockholdersshareholders of lululemon athletica inc. on Thursday,Wednesday, June 2, 2016,9, 2021, beginning at 1:8:00 p.m.a.m., Pacific Time. This year'sThe annual meeting will be a completely virtual meeting of stockholders,shareholders, which will be conducted solely via live webcast. You will be able to attend the annual meeting of stockholdersshareholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/LULU2016.lulu2021. You also will be able to vote your shares electronically at the annual meeting.

We are excited to continue to embrace the latest technology to provide expanded access, improved communication, and cost savings for our stockholdersshareholders and the company. We believe hosting a virtual meeting willhelps enable increased stockholdergreater shareholder attendance at the annual meeting by allowing shareholders that might not otherwise be able to travel to a physical meeting to attend online and participationparticipate from any location around the world.

Details regarding how to attend the meeting online and the business to be conducted at the annual meeting are more fully described in the accompanying Notice of Annual Meetingnotice and Proxy Statement.proxy statement.

This year we are again providing access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission's "notice and access" rules. As a result, we are mailingsending to many of our stockholdersshareholders a notice instead of a paper copy of this proxy statement and our 2015 Annual Report.2020 annual report. The notice contains instructions on how to access those documents over the Internet. The notice also contains instructions on how each of those stockholdersshareholders can receive a paper copy of our proxy materials, including this proxy statement, our 2015 Annual Report,2020 annual report, and a form of proxy card or voting instruction card. All stockholdersshareholders who do not receive a notice, including stockholdersshareholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy of the proxy materials by mail unless they have previously requested delivery of proxy materials electronically. Continuing to employ this distribution process will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

Your vote is important. Regardless of whether you plan to participate in the annual meeting online, we hope you will vote as soon as possible. You may vote by proxy over the Internet, telephone or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, telephone, or by writtenpaper proxy, or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend the virtual meeting.

Thank you for your ongoing support of, and continued interest in, lululemon.

Sincerely,

|

| |

/s/ Laurent PotdevinCalvin McDonald |

Laurent PotdevinCalvin McDonald |

| Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

To Be Held June 2, 2016

Notice is hereby given thatYou are invited to attend the 20162021 annual meeting of the stockholdersshareholders of lululemon athletica inc., a Delaware corporation, will be held on corporation.

Date

June 2, 2016, beginning9, 2021 at 1:8:00 p.m.a.m., Pacific Time via live(Online check-in will begin at 7:30 a.m., Pacific Time)

Virtual Meeting

Live webcast at www.virtualshareholdermeeting.com/LULU2016, for the following purposes:lulu2021.

1. To elect three Class III directors to hold office for a three-year term and until their respective successors are elected and qualified.

2. To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 29, 2017.Proposals

3. To transact such other business as may properly come before the meeting. | | | | | | | | | | | | | | |

| Proposal | Board recommends you vote: |

| Proposal No. 1 | To elect three Class II directors to hold a three-year term and to elect oneClass Idirector to hold office for a 2-year term, until each director's respective successors are elected and qualified | Forü |

| Proposal No. 2 | To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 30, 2022 | Forü |

| Proposal No. 3 | To approve, on an advisory basis, the compensation of our named executive officers | Forü |

| Other | To transact on other business that may come before, or if properly presented at the meeting | |

Our board of directors recommends that you

Shareholder vote "FOR":

Proposal No. 1 (the election to our board of directors of the three nominees named in this proxy statement); and

Proposal No. 2 (the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 29, 2017).

Other Information

At the 2011 annual meeting of stockholders, our stockholders had the opportunity, on a non-binding advisory basis, to inform us on how often stockholders wish to include a "say-on-pay" proposal in our proxy statement. The voting results showed significant support by stockholders for a "say-on-pay" vote every three years. Accordingly, we held a stockholder advisory vote on executive compensation at our 2014 annual meeting of stockholders. Our next "say-on-pay" vote will be held at our 2017 annual meeting of stockholders.

StockholdersShareholders of record at the close of business on April 13, 20162021, are entitled to notice of and to vote at the annual meeting and any adjournment or postponement thereof. In accordance with our bylaws, aA list of those stockholdersshareholders entitled to vote at the annual meeting will be available for examination by any stockholder,shareholder for any purpose relatinggermane to the meeting for a period of ten days prior to the meeting at our principal offices. If you would like to schedule an appointment to examine the office of the Corporate Secretary, lululemon athletica inc., 1818 Cornwall Avenue, Vancouver, British Columbia, beginning April 22, 2016.shareholder list during this period, please email our company secretary at investors@lululemon.com. The shareholder list will also be available atto shareholders of record during the annual meeting.meeting on the virtual meeting website.

Online Access to Proxy

We are pleased to continue using the U.S. Securities and Exchange Commission's "Notice"notice and Access"access" delivery model allowing companies to furnish proxy materials to their stockholdersshareholders over the Internet. We believe that this delivery process will expedite stockholders'shareholders' receipt of proxy materials and lower the costs and reduce the environmental impact of the annual meeting. On or about April 22, 2016,27, 2021, we intend to mailsend to our stockholdersshareholders a Notice of Internet Availability of Proxy Materials, containing instructions on how to access our proxy statement and Annual Report to Stockholders for the fiscal year ended January 31, 2016,2020 annual report, on how to vote online, and on how to access the virtual annual meeting.meeting and the shareholder list. This notice also provides instructions on how to receive a paper copy of the proxy materials by mail.

Technical Help

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting login page.

All stockholders are invited to attend the annual meeting. The annual meeting will begin promptly at 1:00 p.m., Pacific Time. Online check-in will begin at 12:30 p.m., Pacific Time, and you should allow ample time for the online check-in procedures. Whether or not you plan to attend the annual meeting, please vote your shares via the Internet or telephone, as described in the accompanying materials, as soon as possible to assureensure that your shares are represented at the meeting, or, if you elect to receive a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the virtual meeting you will, of course, have the right to revoke the proxy and vote your shares electronically at the meeting. | | | | | |

| |

| |

| By order of the board of directors, |

| |

| /s/ Laurent PotdevinCalvin McDonald |

| Laurent PotdevinCalvin McDonald |

| Chief Executive Officer |

Vancouver, British Columbia

April 15, 201627, 2021

LULULEMON ATHLETICA INC.

PROXY STATEMENT

20162021 ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

THURSDAY,WEDNESDAY, JUNE 2, 20169, 2021

GENERAL INFORMATION

This proxy statement is being provided to solicit proxies on behalf of the board of directors of lululemon athletica inc. for use at the annual meeting of stockholdersshareholders to be held on Thursday,Wednesday, June 2, 2016,9, 2021, at 1:8:00 p.m.a.m., Pacific Time.

Our principal offices are located at 1818 Cornwall Avenue, Vancouver, British Columbia V6J 1C7.

Virtual Annual Meeting

We are pleased to inform you that this year's meeting will again be a completely virtual meeting, which will be conducted solely via live webcast. You will be able to attend the annual meeting online, vote your shares electronically, and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/LULU2016.lulu2021. We expect to first make this proxy statement available, together with our Annual Report for the fiscal year ended January 31, 2016,2020 annual report, to stockholders on approximately April 22, 2016.

Our principal offices are located at 1818 Cornwall Avenue, Vancouver, British Columbia V6J 1C7.

Internet Availability of Annual Meeting Materials

Under rules adopted by the U.S. Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, to our stockholders of record. All stockholders will have the ability to access the proxy materials on the website referred to in the notice or to request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the notice. You will not receive a printed copy of the proxy materials unless you request one in the manner set forth in the notice. This permits us to conserve natural resources and reduces our printing costs, while giving stockholders a convenient and efficient way to access our proxy materials and vote their shares.

We intend to mail the noticeshareholders on or about April 22, 201627, 2021.

Our board of directors considers the appropriate format for our annual meeting of shareholders on an annual basis. Similar to all stockholderslast year, we have again taken into account the ongoing impact of record entitledCOVID-19, which has heightened public health and travel concerns for in-person annual meetings. Accordingly, we are pleased to continue to embrace the latest technology to provide expanded access, improved communication, and cost savings for our shareholders and lululemon. Our virtual format allows shareholders to submit questions and comments and to vote during the meeting. We believe the virtual meeting format allows our shareholders to engage with us no matter where they live in the world, and is accessible and available on any internet-connected device, be it a phone, a tablet, or a computer. We believe the benefits of a virtual meeting allow our shareholders to have robust engagement with lululemon, and is in the best interests of our shareholders at the annual meeting.this time.

Who May Vote

Only persons who are holders of record of our common stock and holders of record ofor our special votingvoting stock at the close of business on April 13, 2016,2021, which is the record date, will be entitled to notice of and to vote at the annual meeting. On the record date, 127,520,121 sharesdate, 125,127,575 shares of common stock and 9,803,819 shares 5,203,012 shares of special voting stock were issued and outstanding. EachEach share of common stock is entitled to one vote at the annual meeting and each share of special voting stock is entitled to one vote at the annual meeting. Holders of common stock and special voting stock will vote together as a single class on all matters that come before the annual meeting; accordingly,meeting. Accordingly, throughout this proxy statement we refer generally to our outstanding common stock and special voting stock together as our "common stock."

What Constitutes a Quorum

StockholdersShareholders may not take action at the annual meeting unless there is a quorum present at the meeting. StockholdersShareholders participating in the virtual meeting are considered to be attending the meeting "in person." The presence, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote as of the close of business on the record date constitutes a quorum. Abstentions and broker non-votes will count toward establishingeach be counted as present for the purposes of determining the presence of a quorum. Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote the shares. An abstention occurs when a stockholdershareholder withholds such stockholder'sshareholder's vote by checking the "abstain" box on the proxy card, or similarly elects to abstain via the Internet or telephone voting. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, including the ratification of the appointment of an independent registered accounting firm.

Vote Required

Proposal No. 1: A nominee for director will be elected to the board if the votes cast for the nominee's election exceed the votes cast against that nominee's election.election at the meeting. Abstentions and broker non-votes will have no effect on the outcome of the election and we do not have cumulative voting in the election of directors.

Proposal No. 2: The ratification of the appointmentselection of our independent registered public accounting firm requires the affirmative vote of a majority ofwill be ratified if the votes cast for this proposal exceed the votes cast against this proposal at the annual meeting or represented by proxymeeting. Abstentions and entitled to vote.broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 3: The compensation of our named executive officers will be approved, on an advisory basis, if the votes cast for this proposal exceed the votes cast against this proposal at the meeting. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Voting Process

Shares that are properly voted or for which proxy cards are properly executed and returned will be voted at the annual meeting in accordance with the directions given or, ingiven. In the absence of directions, these shares will be voted "FOR" the election of the director nominees named in this proxy statement, and "FOR" Proposals No. 12 and 2.No. 3.

We do not expect any other matters to be brought before the annual meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their discretion with respect to those matters.

The manner in which your shares may be voted depends on how your shares are held. If you are the record holder of your shares, meaning you appear as the holder of your shares on the records of our stock transfer agent, you may vote those shares via the Internet or telephone, or, if you request a printed copy of the proxy materials, via a proxy card for voting those shares included with the printed proxy materials. If you own shares in street name, meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you may instead receive a notice with instructions on how to access proxy materials as well as how you may instruct your bank or brokerage firm how to vote your shares.

Voting on the Internet

| | | | | | | | | | | |

| Voting on the Internet | You can vote your shares via the Internet by following the instructions in the notice. The Internet voting procedures are designed to authenticate your identity and to allow you to vote your shares and confirm your voting instructions have been properly recorded. If you vote via the Internet, you do not need to complete and mail a proxy card. We encourage you to vote your shares via the Internet in advance of the annual meeting even if you plan to attend the virtual annual meeting.Voting by Mail

You can vote your shares by mail by requesting a printed copy of the proxy materials sent to your address. When you receive the proxy materials, you may fill out the proxy card enclosed therein and return it per the instructions on the card. By signing and returning the proxy card according to the instructions provided, you are enabling the individuals named on the proxy card, known as "proxies," to vote your shares at the annual meeting in the manner you indicate. If you request a printed copy of the proxy materials, we encourage you to sign and return the proxy card even if you plan to attend the annual meeting.

Voting by Telephone

You may be able to vote by telephone. If so, instructions in the notice. The Internet voting procedures are designed to authenticate your identity and to allow you to vote your shares and confirm your voting instructions have been properly recorded. If you vote via the Internet, you do not need to complete and mail a proxy card. We encourage you to vote your shares via the Internet in advance of the annual meeting even if you plan to attend the annual meeting.

|

| Voting by Mail | You can vote your shares by mail by requesting a printed copy of the proxy materials sent to your address. When you receive the proxy materials, you may fill out the proxy card enclosed therein and return it per the instructions on the card. By signing and returning the proxy card according to the instructions provided, you are enabling the individuals named on the proxy card, known as "proxies," to vote your shares at the annual meeting in the manner you indicate. If you request a printed copy of the proxy materials, we encourage you to sign and return the proxy card even if you plan to attend the annual meeting. |

| Voting by Telephone | You can vote your shares by telephone. Instructions are included with your notice. If you vote by telephone, you do not need to complete and mail your proxy card. |

Attendance and Voting at the Annual Meeting

Most of our stockholdersshareholders hold their shares through a broker, trustee or other nominee rather than directly in their own name. There are some distinctions between shares held of record and those owned beneficially. If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the "stockholder"shareholder of record." As the stockholdershareholder of record, you have the right to attend the meeting, grant your voting proxy directly to lululemon or to a third party, or to vote your shares during the meeting. If your shares are held in a brokerage account, by a trustee or by another nominee (that is, in "street name"), you are considered the "beneficial owner" of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee or nominee how to vote, or to vote your shares during the annual meeting.

Revocation

If you are the record holder of your shares, you may revoke a previously granted proxy at any time before the annual meeting by delivering to the Corporate Secretarycompany secretary of lululemon athletica inc. a written notice of revocation or a duly executed proxy bearing a later date or by voting your shares electronically at the annual meeting. Any stockholdershareholder owning shares in street name may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the shares. Simply attending the annual meeting does not revoke your proxy. Your last vote, prior to or at the annual meeting, is the vote that will be counted.

Householding

The SEC permits companies to send a single notice, and for those stockholdersshareholders that elect to receive a paper copy of proxy materials in the mail, one copy of this proxy statement, together with our 2015 Annual Report,2020 annual report, to any household at which two or more stockholdersshareholders reside, unless contrary instructions have been received, but only if we provide advance notice and follow certain procedures. In such cases, each stockholdershareholder continues to receive a separate notice, and for those stockholdersshareholders that elect to receive a paper copy of proxy materials in the mail, one copy of our 2015 Annual Report2020 annual report and this proxy statement. This householding process

reduces the volume of duplicate information and reduces printing and mailing expenses. We have not instituted householding for stockholdersshareholders of record; however, certain brokerage firms may have instituted householding for beneficial owners of our common stock

held through brokerage firms. If your family has multiple accounts holding our common stock, you may have already received a householding notification from your broker. Please contact your broker directly if you have any questions or require additional copies of the notice, our 20152020 annual report and this proxy statement. The broker will arrange for delivery of a separate copy of the notice, and, if so requested, a separate copy of these proxy materials promptly upon your written or oral request. You may decide at any time to revoke your decision to household, and thereby receive multiple copies.

Solicitation of Proxies

We pay the cost of soliciting proxies for the annual meeting. We solicit by mail, telephone, personal contact and electronic means and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send notices, and if requested, other proxy materials, to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either personally or by telephone, facsimile, mail, email or written orother methods of electronic mail. Stockholderscommunication. Shareholders are requested to return their proxies without delay.

YEAR IN REVIEW

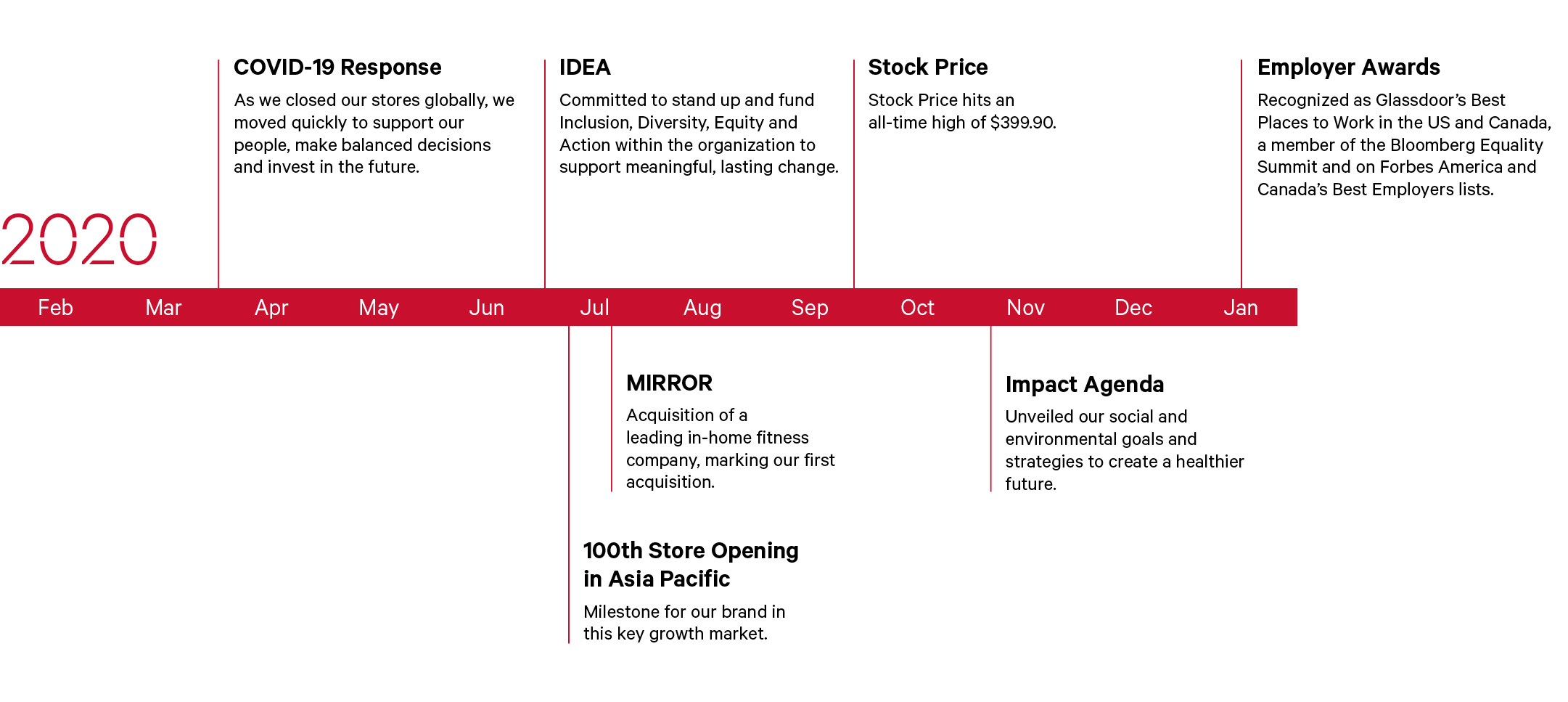

COVID-19 Fiscal 2020 was a difficult year. We faced a rapidly changing global landscape, and we faced it united, with resilience and resolve. As we temporarily closed stores around the world, we continued to support our people, and implemented programs to support and keep them safe:

•Global Pay Protectionprovided pay and job protection for our employees during temporary store closures. As we re-opened, we kept our pay guarantee in place should a store need to close again for any reason. We now have a minimum pay guarantee policy by role.

•We Stand Together Fundwas created to support our employees facing significant financial hardship with relief grants. To establish the fund, our senior leadership team contributed 20% of their salaries and members of our board of directors contributed 100% of their cash retainers for a period of three months. The fund allows for employee donations and we plan to continue to offer the program on an enduring basis to support employees both during COVID-19 and beyond.

•Ambassador Relief Fundwas an extension of our support to our collective community where we provided $4.5 million to assist ambassador-run fitness studios with basic operating costs.

•Enhanced mental health support and toolswere implemented, including a wide range of resiliency and connection sessions specifically created to support our people and collective during the pandemic.

As we continue to navigate the COVID-19 pandemic, we continue to prioritize the safety of our people and our guests. We are closely monitoring the situation in every market and community we serve. We will temporarily close stores and restrict operations as necessary based upon information from governmental and health officials.

Inclusion, Diversity, Equity and Action (IDEA) The Black Lives Matter movement acted as a powerful catalyst within our organization in fiscal 2020. After many real and impactful conversations with our underrepresented employees and our greater community, we heard that we need to evolve within our own walls to support meaningful, lasting change in the world. We added "Inclusion" as one of our core values, and established IDEA Advisory and Steering Committees, led by our chief executive officer. We hired our global head of IDEA and built a team to work to meet our commitments. We invested $5 million in 2020, and plan to continue investing in 2021 to fund our global IDEA activities. These funds can further support the career progress of our diverse talent and increase access to internal opportunities and professional development.

MIRROR In June 2020, we announced the acquisition of MIRROR, a leading, in-home fitness company. This marked our first acquisition and is a compelling addition to our omni guest experiences growth pillar. We are excited to bolster our digital sweatlife offerings and bring immersive and personalized in-home sweat and mindfulness solutions to our guests.

Senior Leadership Team As we continue to expand globally, André Maestrini joined our team as our executive vice president, international to lead our operations in Asia Pacific, China, and Europe, Middle East and Africa (EMEA). Additionally, we promoted Meghan Frank to be the first woman to hold the chief financial officer position at lululemon. In another milestone, Celeste Burgoyne's role evolved to become our first executive to serve at the president level as she leads the Americas and global guest innovations team.

Stores As our international growth continued in fiscal 2020, we celebrated our 100th store opening in our Asia Pacific region in fiscal 2020 and have continued to build our international footprint opening even more locations globally. We opened our largest store in Asia to date, in Tokyo, Japan. We continued to open more pop-up store locations (over 100 seasonal stores) to support our guests during the holiday season. During the year, we opened 30 net new company-operated stores, including 18 stores in Asia Pacific, nine stores in North America, and three stores in Europe.

Financial Highlights Fiscal 2020 was a year in which we had to adapt our priorities, and evolve our strategies, to navigate the challenges of the COVID-19 pandemic, global climate crisis, and systemic inequities in our society. We established cross functional teams across the business to ensure we could continue to serve our guests where, when, and how they wanted to shop. As we reported in our Annual Report for fiscal 2020, from 2020 compared to 2019:

•Net revenue increased 11% to $4.4 billion.

•Company-operated stores net revenue decreased 34% to $1.7 billion.

•Direct to consumer net revenue increased 101% to $2.3 billion.

•Gross profit increased 11% to $2.5 billion.

•Gross margin increased 10 basis points to 56.0%.

•Income from operations decreased 8% to $820.0 million.

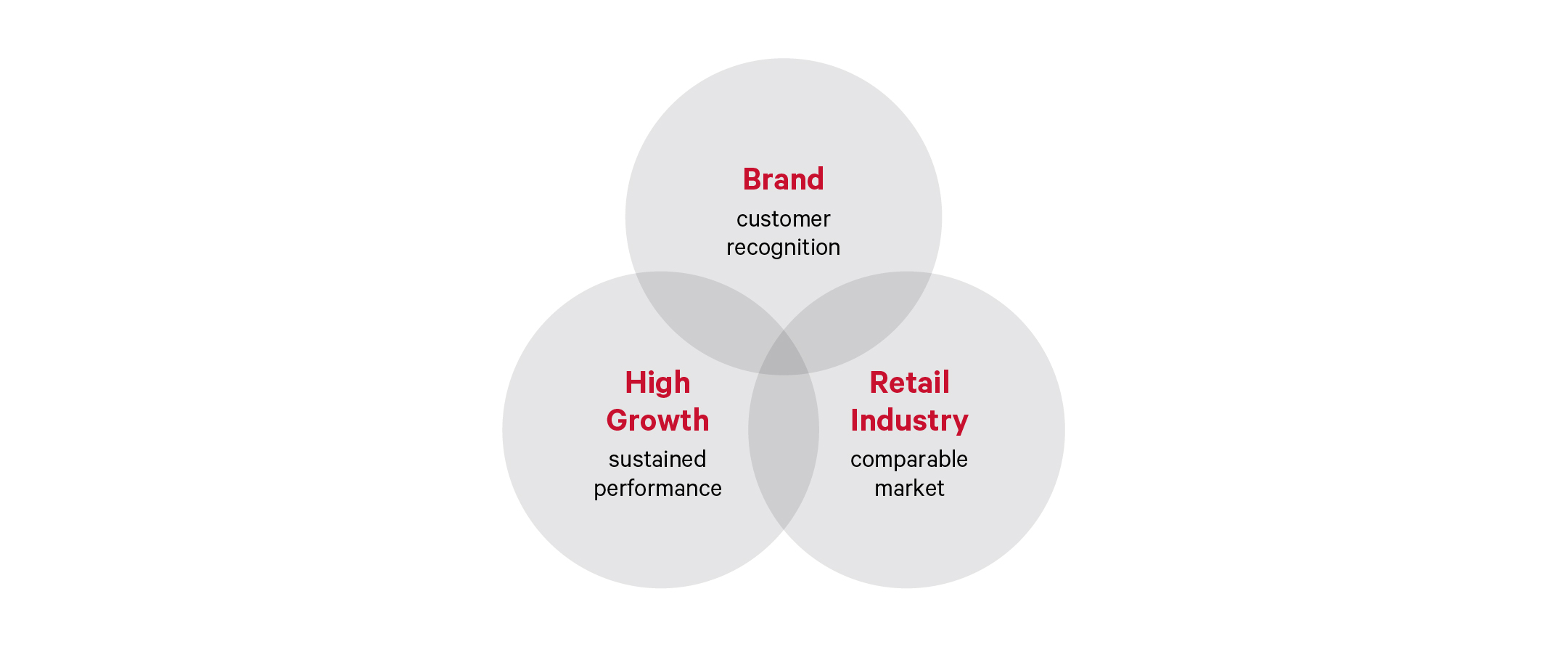

As we continue to navigate the global pandemic, we remain committed to our Power of Three growth plan and the targets contemplated by this plan which include a doubling of our men's business, a doubling of our e-commerce business, and a quadrupling of our international business by 2023 from levels realized in 2018. Our three strategic pillars of the plan are:

•Product Innovation: Our product assortment was met with strong guest response throughout 2020. We continued to leverage our Science of Feel development platform, and introduced more inclusive sizing into our core women's styles in 2020 with additional styles to be added in 2021.

•Omni-Guest Experience: The COVID-19 pandemic impacted the way guests interacted with our brand in 2020 as store traffic declined. This was offset by significant strength in our e-commerce business as we invested in IT infrastructure, fulfillment capacity and increased the number of educators assisting guests in our Guest Education Center. Revenue in our e-commerce channel increased 101% in 2020.

•Market Expansion: We continued to grow our presence both in North America and in our international markets. Our expanded seasonal store strategy allowed us to better cater to our guests in select markets, while also helping introduce new guests to our brand. For 2020, our business in North America increased 8%, while total growth in our international markets was 31%.

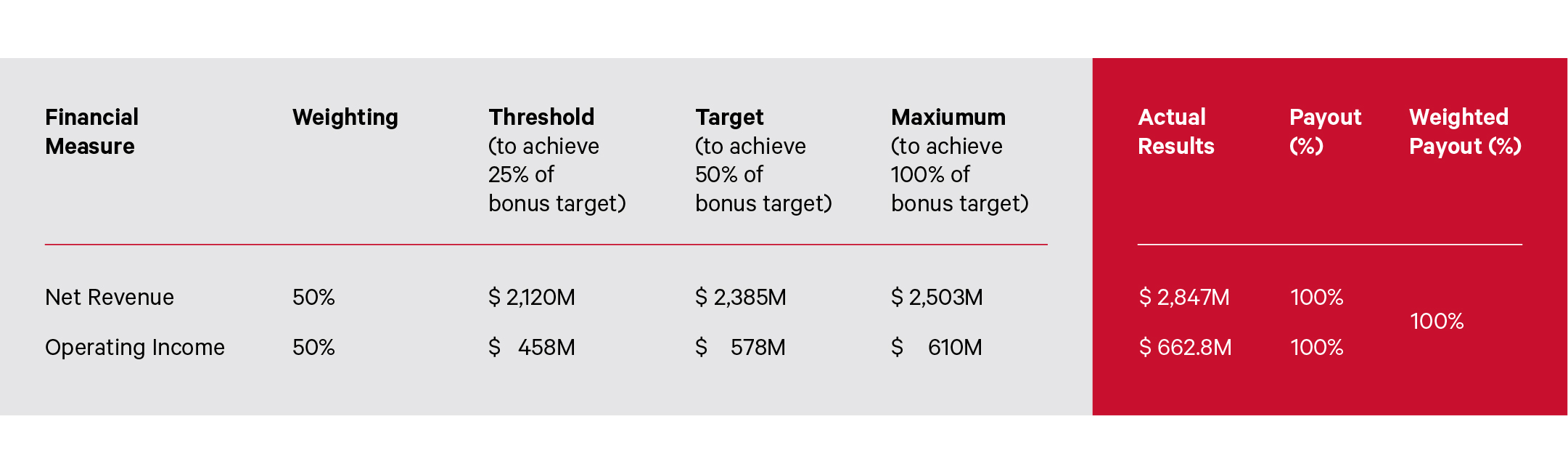

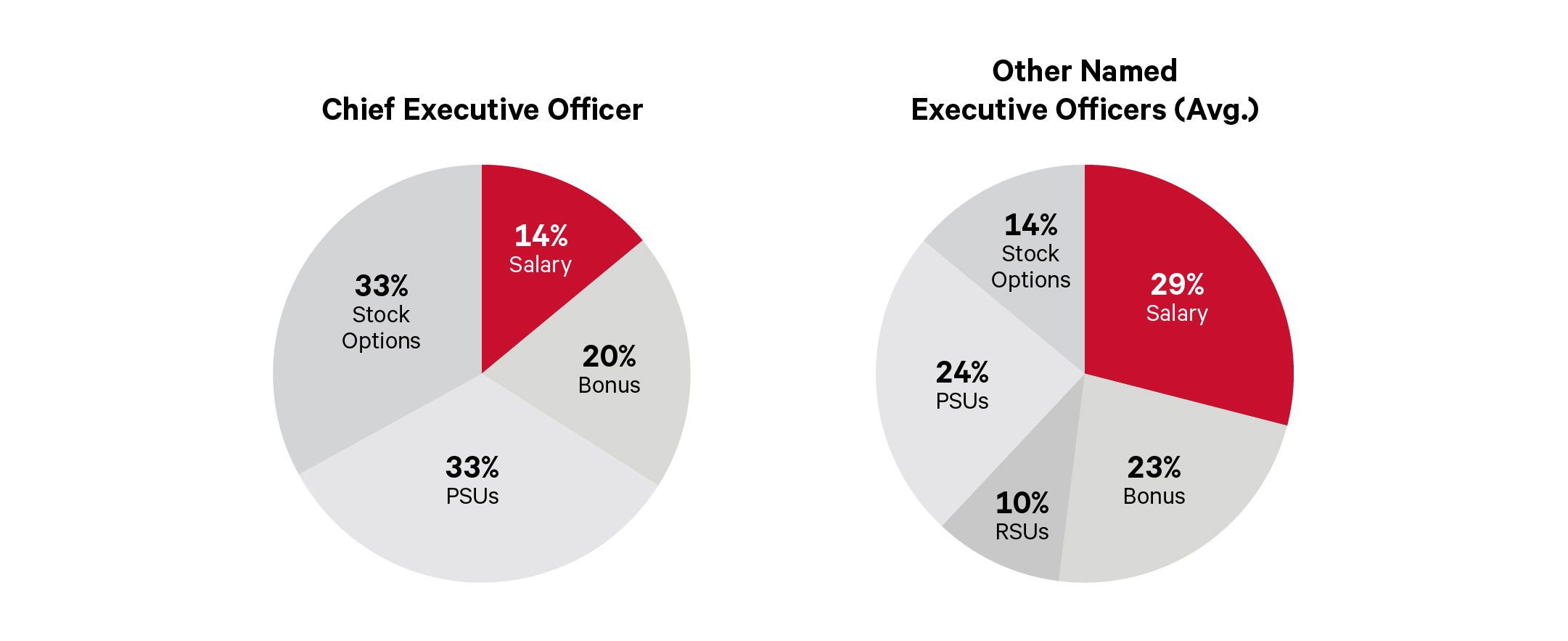

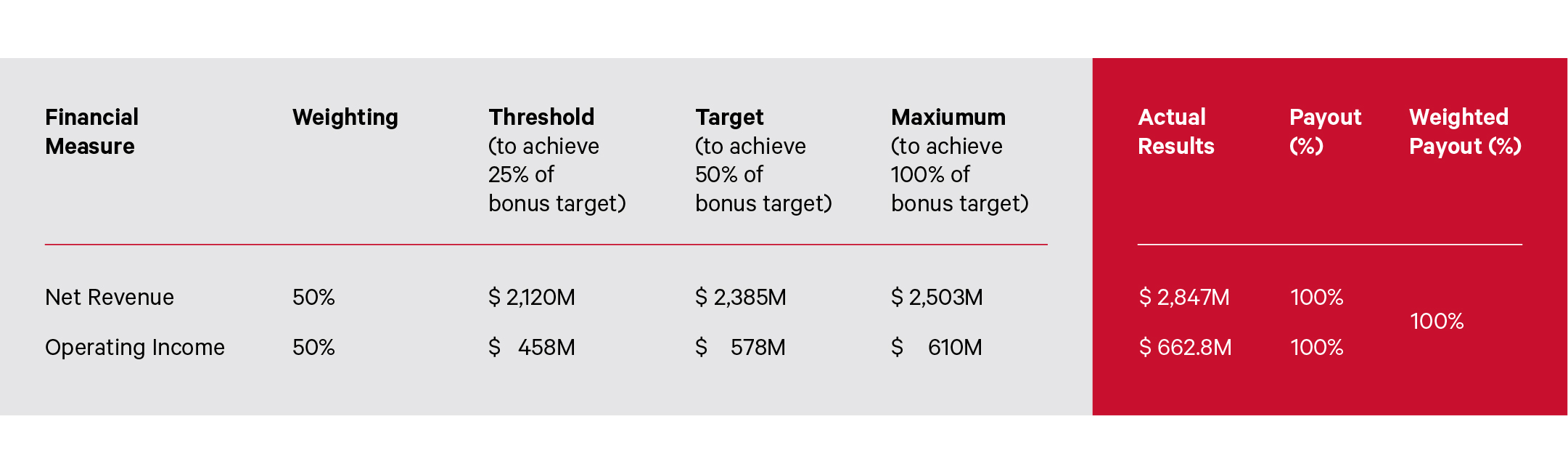

In this year of uncertainty, we made the decision to cap our annual bonus payouts for fiscal 2020 at 100% of target (as opposed to our typical maximum of 200% of target). Additionally, we aligned our bonus goals to our financial results in the second half of the year to position bonus goals with our financial recovery. Our priorities, as described above, were to fund our global pay protection program, as well as other initiatives focused on our collective, including our We Stand Together Fund and Ambassador Relief Fund. We ended our year in a strong financial position, which exceeded our bonus targets established for the second half of the year. Therefore, our fiscal 2020 bonus goals were achieved at 100% of target.

IMPACT AGENDA

Our purpose is to elevate the world by unleashing the full potential within every one of us.The Impact Agenda is our stake in the ground toward an equitable, sustainable future. Our strategy is organized into three interconnected pillars, each with a vision for success, goals and commitments, and strategies.

BE HUMAN

Inclusion, Diversity, Equity, and Action (IDEA)

We continually endeavor to create an environment that is equitable, inclusive, and fosters personal growth.

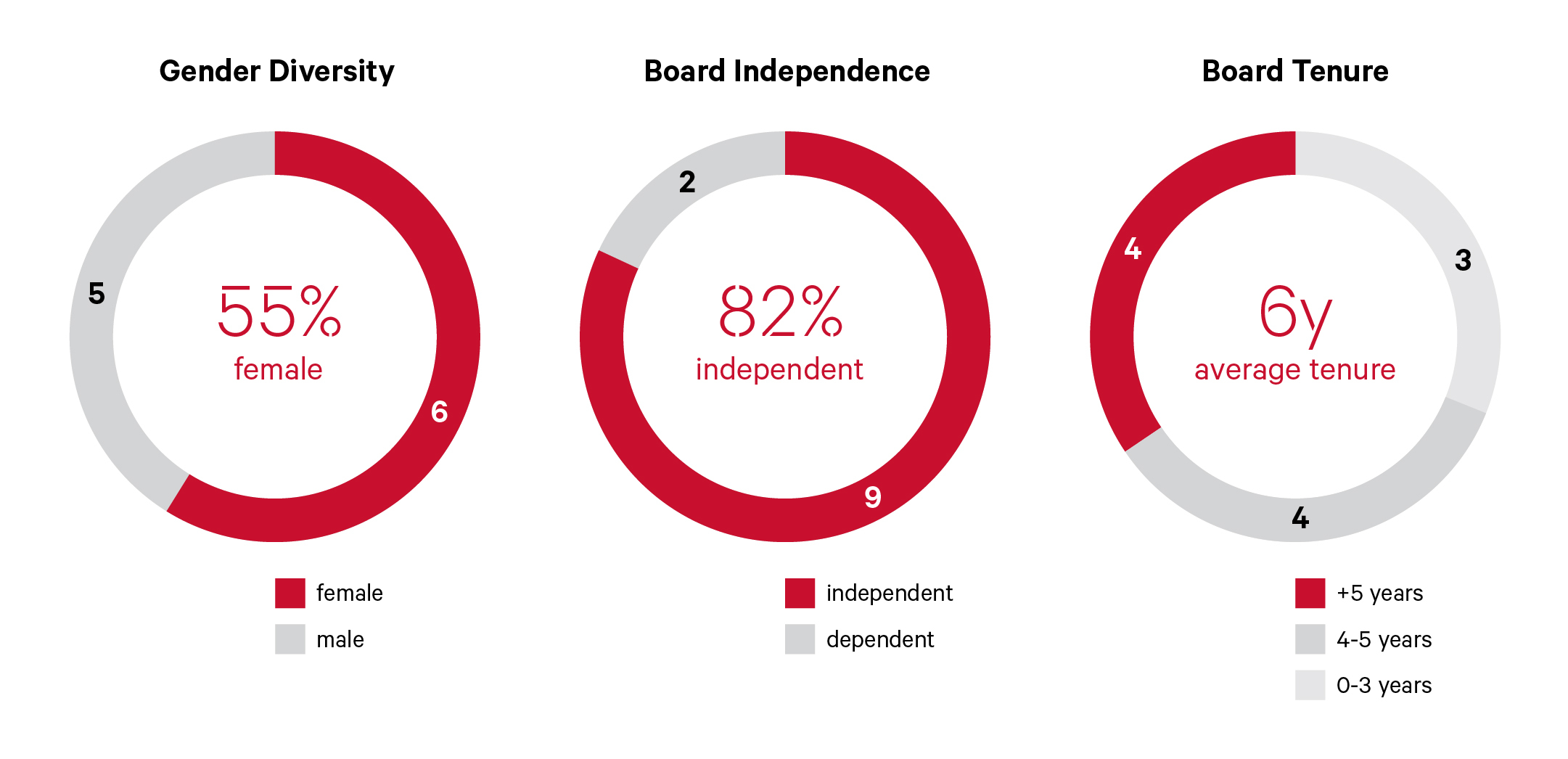

Diversity and inclusion are key components of our culture and are fundamental to achieving our strategic priorities and future vision. The diversity of our teams and working in an inclusive culture enables increased employee engagement, better decision making, greater adaptability, creativity, and a deeper understanding of the communities we serve. We are proud that as of January 31, 2021, approximately 55% of our board of directors, 65% of our senior executive leadership team, and 50% of all vice presidents and above are women, while approximately 75% of our overall workforce are women(1).

We maintain 100% gender pay equity within our entire global employee population, meaning equal pay for equal work across genders. We have achieved pay equity across all areas of diversity in the United States and are seeking, to the extent permitted under local law and regulation, to collect the data necessary to confirm complete pay equity globally.

We offer all employees IDEA education, training, support, and guided conversations on a variety of topics, including anti-racism, anti-discrimination, and inclusive leadership behaviors, in a variety of forums. We aim to foster a culture of inclusion by making IDEA part of our everyday conversation, and frequently review our policies, programs, and practices to identify ways to be more inclusive and equitable.

Supporting our employees through whole-person opportunities

We believe that each of our approximately 25,000people are key to the success of our business. We strive to foster a distinctive culture rooted in our core values that attracts and retains passionate and motivated employees who are driven to achieve personal and professional goals. We believe our people succeed because we create an environment that fosters growth and is diverse and equitable.

We assess our performance and identify opportunities for improvement through an annual employee engagement survey. In 2020 our survey participation rate was more than 90% and our employee engagement score was in the top 10% of retailers(2). Our engagement score tells us whether our employees believe lululemon is a great place to work, whether they believe they are able to use their strengths at work, if they are motivated, and whether they would recommend lululemon as a great place to work.

We understand that health and wealth programs need to offer choice at all stages of life. Our current offerings to support whole-person opportunities include, among other things:

•Competitive compensation which rewards exceptional performance;

•A parenthood program which is a gender-neutral benefit that provides all eligible employees up to six months of paid leave;

•An employee assistance program which provides free, confidential, support to all our employees and their families in a variety of areas from mental well-being to financial services to advice for new parents;

•Personal resilience tools and mental health sessions to employees, ambassadors, and suppliers;

•Reimbursement programs which reward physical activity; and

•A Fund your Future program for eligible employees which offers partial contribution matches to a pension plan and employee share purchase plan.

________

(1)While we track male and female genders, we acknowledge this is not fully encompassing of all gender identities.

(2)Based on an industry benchmark provided by the third party that administers this survey to our employees.

Supporting the wellbeing of the people who make our products in our supply chain

We partner with our suppliers to work towards creating safe, healthy, and equitable environments that support the wellbeing of all the people who make our products. Our Vendor Code of Ethics is the foundation of our supplier partnerships. It adheres to international standards for working conditions, workers’ rights, and environmental protection, and its implementation focuses on prevention, monitoring, and improvement. Beyond labor compliance, we are committed to supporting worker wellbeing, building

on years of partnerships with our suppliers around workplace practices and community support initiatives.

We recently developed and implemented our Foreign Migrant Worker Standard, which outlines our expectations with respect to foreign migrant workers. This program, which has successfully been executed in Taiwan, has benefited approximately 2,700 migrant workers by reducing worker-paid fees. Based on lessons learned from this program, we are now expanding beyond Taiwan so that we can continue to support our foreign migrant workers globally.

BE WELL

Everyone has the right to be well. Yet globally, more people are facing stress and anxiety in their everyday lives, exacerbated by COVID-19, social injustice, and environmental anxiety. At lululemon, we are committed to wellbeing for all. When we all have the tools, resources, and agency to be well, we can realize our full potential and contribute to a healthier future. As a brand rooted in movement, mindfulness, and connection, we know these practices have the power to support mental, physical, and social wellbeing. To support the critical need for wellbeing, we are providing access to tools for at least 10 million people globally, including our guests, suppliers, and members of our communities. Areas of focus for us include:

Establish a Centre for Social Impact In 2021, we plan to establish a lululemon centre of excellence for social impact that will help unify and amplify existing programs such as Here to Be and innovate new programs to advance equity in wellbeing in our communities.

Here to Beis our flagship social impact program. Launched in 2016, Here to Be committed $25 million over five years to partner with nonprofit organizations that create equitable access to yoga, running, and meditation. This year, in response to a growing need for wellbeing, we took action to scale Here to Be and deepen its impact. We evolved its mission with a clear focus on equity. We expanded partnerships to include organizations that advocate for social justice. The program provides support that includes funding, connection to tools and resources, and amplification across our platforms. Through partnerships in regions where we operate, we plan to scale our reach and impact.

Peace on Purpose was created in partnership with the United Nations (UN) Foundation, to provide mindfulness tools to UN humanitarian workers. Working on the front lines of global crises and natural disasters, UN staff report high rates of burnout, stress, compassion fatigue, and mental health stigmas in their work. Peace on Purpose is an evidence-based and trauma-informed program that equips UN workers with mindfulness resources to support their mental, physical, and emotional wellbeing. To date, Peace on Purpose has reached humanitarian employees in 11 countries through in-person workshops and in 87 countries through digital workshops. In 2020, we launched mindfulness tools in partnership with Insight Timer, a global meditation app.

BE PLANET

We envision a future where we thrive within the limits of our one planet. That is why we act to avoid environmental harm and contribute to restoring a healthy planet. At lululemon, we create products and experiences that reflect the values of our guests and our aspirations for a healthier world. We will work to be part of a circular ecosystem, based on principles of designing out waste and pollution, keeping products and materials in use, regenerating natural systems, and using clean renewable energy. Underlying is the imperative to act on climate change, and we have set ambitious, science-based carbon targets that are linked to our Be Planet goals. By transforming our materials and products, guest experience models, and supply chains and by partnering with our collective, suppliers, and industry stakeholders, we take responsibility to help evolve our industry toward a more sustainable future. Our focus areas are as follows:

Innovate Sustainable Materials Our intent is to design our products for long-lasting performance, beauty, and sustainability. We are working to adopt better fibres, evolve manufacturing processes, innovate net new materials, and engage in industry collaborations to help evolve collective solutions. We assess impacts using the Sustainable Apparel Coalition Higg Materials Sustainability Index (Higg MSI) and select life-cycle analysis methodologies. A key goal is for all our materials to come from traceable sources.

Create circularity through new guest models We are in the early stages of a transformation toward a circular ecosystem. Circularity inspires a whole new way of creating and accessing products – away from a linear approach and toward a creative and regenerative model that engages guests and keeps products in use as long as possible.

Act on climate change and renewable energy In 2019, we created science-based targets approved by the Science Based Targets initiative. We are implementing strategies to invest in the transition to renewable energy, drive carbon reduction and energy efficiency across our value chain, and collaborate across industries for progress.

Use less water and better chemistry Creating, processing, and dyeing materials requires clean water. As part of the solution, we are assessing water limits in our supply chain and have initiated projects with our suppliers to manufacture products in ways that are radically more water-efficient. We plan to continue to elevate chemicals management and promote the use of better chemistries to achieve the highest product performance, protect people and the environment, and comply with regulation and industry standards.

Make waste obsolete The apparel industry has opportunities to reduce waste across our value chain, including in manufacturing, in stores and distribution centres, and in our shipping and product packaging.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a classified board of directors currently consistingwith a total of 12eleven directors, including four Class I directors, four Class II directors, and four three Class III directors who will serve until the annual meetings of stockholdersshareholders to be held in 2017, 20182023, 2021 and 2016, respectively, and until their respective successors are duly elected and qualified or until their earlier resignation or removal. Effective2022, respectively. One of our current Class II directors, Tricia Glynn, will not stand for re-election at the annual meeting.Accordingly, effective as of the 20162021 annual meeting, our board of directors will consist of 11ten directors, including four Class I directors, fourthree Class II directors, and three Class III directors.

At each annual meetingDirector Nominees for Election at the 2021 Annual Meeting of stockholders,Shareholders

New and re-nominated directors are elected for a term of three years to succeed those directors whose terms expire atevaluated by the annual meeting dates.The term of the Class III directors will expire on the date of the upcoming annual meetingcorporate responsibility, sustainability and three people are to be elected to serve as Class III directorsgovernance committee of our board of directors at the annual meeting. Based on allusing information available toabout the Nominating and Governance Committee of our board of directors and relevant considerations, including the guidelines,candidate, criteria and procedures for identifying and evaluating candidates for election to the board of directors set forthincluded in our "Guidelines"guidelines for Evaluating Director Candidates",evaluating director candidates."

As the Nominating and Governance Committee selected Robert Bensoussan, Kathryn Henry, and Jon McNeill, each of whomterm for ourClass II directors is a current Class III director, asexpiring at the candidates who, in2021 annual meeting, the view of the Nominating and Governance Committee, are most suited for membership on our board of directors at this time. Accordingly, the Nominating and Governance Committee recommended Mr. Bensoussan, Ms. Henry, and Mr. McNeill as nominees for election as Class III directors. Our board considered the recommendation of the Nominating and Governance Committee, as well as all information available to it and other relevant considerations, andcommittee has nominated the individuals noted below for election by the stockholders as Class III directors Mr. Bensoussan, Ms. Henry, and Mr. McNeill.re-election. If elected, Mr. Bensoussan, Ms. Henry, and Mr. McNeillthe directors will serve as Class III directorsfor a three-year term until our 2024 annual meeting, of stockholders in 2019 and until their successors are duly elected and qualified, or until their earlier resignation or removal.

On November 18, 2020, our board of directors appointed Kourtney Gibson as our newest director, and determined our shareholders should have the opportunity to vote on the nomination as a continuing Class I director at this annual meeting. If elected, Ms. Gibson will serve until our 2023 annual meeting, and until her successor is duly elected and qualified or until her earlier resignation or removal.

| | | | | | | | | | | | | | |

| Name | | Age(1) | | Director Since |

| Class II directors (whose terms would expire at the 2024 annual meeting) | | |

| Calvin McDonald | | 49 | | 2018 |

| Martha Morfitt | | 63 | | 2008 |

| Emily White | | 42 | | 2011 |

| Class I director (whose term would expire at the 2023 annual meeting) | | |

| Kourtney Gibson | | 40 | | 2020 |

(1) Age as of April 1, 2021.

Please see the "Director Biographies" in the corporate governance section for each director's full biography.

Our board of directors has no reason to believe that any of the nominees listed above will be unable to serve as a director. If, however, any nominee becomes unavailable, the proxies will have discretionary authority to vote for a substitute nominee. There are no family relationships among any of the directors or executive officers.

Unless authority to do so is withheld, the persons named as proxies will vote "FOR" the election of the nominees listed above.

The following table sets forth the name, age, and principal occupation of each director and director nominee, and the period during which each has served as a director of lululemon. Thomas G. Stemberg, who served as a director since 2005, passed away in October 2015.

|

| | | | | | |

| Name |

| Age |

| Occupation |

| Director Since |

| Class I directors whose terms expire at the 2017 annual meeting |

|

|

| Michael Casey |

| 70 |

| Retired Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Starbucks Corporation |

| 2007 |

| RoAnn Costin |

| 63 |

| President of Wilderness Point Investments |

| 2007 |

| David M. Mussafer | | 52 | | Managing Partner of Advent International Corporation | | 2014 |

| Laurent Potdevin |

| 48 |

| Chief Executive Officer of lululemon |

| 2014 |

| | | | | | | |

| Class II directors whose terms expire at the 2018 annual meeting |

|

|

| Steven J. Collins | | 46 | | Managing Director of Advent International Corporation | | 2014 |

| Martha A.M. Morfitt |

| 58 |

| Principal of River Rock Partners Inc. |

| 2008 |

| Rhoda M. Pitcher |

| 61 |

| Managing Partner of Rhoda M Pitcher Inc. |

| 2005 |

| Emily White |

| 37 |

| Founder and Chief Executive Officer of Mave, Inc. |

| 2011 |

| | | | | | | |

| Class III directors whose terms expire and who are nominees for election at the 2016 annual meeting |

|

|

| Robert Bensoussan |

| 57 |

| Director of Sirius Equity LLP |

| 2013 |

| Kathryn Henry |

| 50 |

| Strategic Consultant |

| 2016 |

| Jon McNeill | | 48 | | President, Global Sales, Delivery and Service of Tesla Motors, Inc. | | 2016 |

| | | | | | | |

| Class III director whose term expires at the 2016 annual meeting | | |

| William H. Glenn |

| 59 |

| President and Chief Executive Officer of American Express Global Business Travel |

| 2012 |

Director Nominees

Background information on each of Robert Bensoussan, Kathryn Henry, and Jon McNeill, our three Class III nominees, appears under "Corporate Governance — Our Board of Directors".

Vote Required and Board Recommendation

If a quorum is present, and voting, a nominee for director will be elected to the board of directors if the votes cast for the nominee's election exceed the votes cast against that nominee's election. If an incumbent director fails to receive the required vote for re-election, then, within 90 days following certification of the stockholdershareholder vote by the inspector of elections, the board of directors will act to determine whether to accept the director's resignation. Abstentions and broker non-votes will have no effect on the outcome of the election. Broker non-votes occur when a person holding shares in street name, such as through a brokerage firm, does not provide instructions as to how to vote those shares and the broker does not then vote those shares on the stockholder's behalf.

Our board of directors unanimously recommends a vote "FOR""FOR" the election of the three Class III directorII nominees and the one Class I nominee named above.

CORPORATE GOVERNANCE

Our Board of Directors

The following is brief descriptiontable states the name, age, and principal occupation of each nominee who is currently a member of the board of directors and each director of lululemon whose term of office will continue after the annual meeting:

Class III Director Nominees for Election at the 2016 Annual Meeting of Stockholders

Robert Bensoussan has been a member of our board ofcurrent directors since January 2013. Since 2008, Mr. Bensoussan has been a Director(including the nominees to be elected at this meeting), and the majority owner of Sirius Equity LLP, a UK company that invests in retail and brands based in the UK and Europe. From 2008 to 2012, Mr. Bensoussan served as Executive Chairman and CEO of LK Bennett, a UK fashion retailer, and has acted as non-Executive Chairman since 2012, and he has served as non-Executive Chairman of feelunique.com (UK) since December 2012. From 2001 to 2007, Mr. Bensoussan was CEO of Jimmy Choo Ltd, a privately held UK luxury shoe wholesaler and retailer and was also a member of the Board of Jimmy Choo Ltd from 2001 to 2011. Mr. Bensoussan serves on the boards of directors of Inter Parfums Inc., a publicly-traded manufacturer of fragrances and fragrance-related products, Celio International (Belgium), a retailer of men's clothing, Zen Cars (Belgium), an electric car rental company, and Aurenis (France) a part-works publisher. Our board of directors selected Mr. Bensoussan to serve as director because he has extensive executive management and director experience in the apparel, accessories and fragrances industry. Our board of directors believes his experience as chief executive officer and director of international branded luxury goods operations provides unique insight and vision to our board of directors.

Kathryn Henry has been a member of our board of directors since January 2016. Since 2015, Ms. Henryperiod during which each has served as a strategic consultant for retail and technology companies, in addition to venture capital, investment and consulting firms seeking executive level guidance.director of lululemon.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age(1) | | Occupation | | Director Since |

| Class I directors (whose terms expires at the 2023 annual meeting) | | |

| Michael Casey | | 75 | | Retired Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Starbucks Corporation | | 2007 |

| Glenn Murphy | | 59 | | Founder and Chief Executive Officer of FIS Holdings | | 2017 |

| David Mussafer | | 57 | | Chairman and Managing Partner of Advent International Corporation | | 2014 |

| Class I director (who is a nominee to continue as a Class I director at the 2021 annual meeting) |

| Kourtney Gibson | | 40 | | President of Loop Capital Markets | | 2020 |

| Class II directors (whose terms expire and who are nominees for election at the 2021 annual meeting) | | |

| Calvin McDonald | | 49 | | Chief Executive Officer of lululemon athletica inc. | | 2018 |

| Martha Morfitt | | 63 | | Principal of River Rock Partners Inc. | | 2008 |

| Emily White | | 42 | | President of Anthos Capital | | 2011 |

| Class III directors (whose terms expire at the 2022 annual meeting) | | |

| Kathryn Henry | | 55 | | Strategic Advisor and Independent Consultant | | 2016 |

| Jon McNeill | | 53 | | Chief Executive Officer of DVx Ventures | | 2016 |

| Stephanie Ferris | | 47 | | Former Chief Operating Officer of Fidelity National Information Services, Inc. (FIS) | | 2019 |

| Class II director (whose term expires at the 2021 annual meeting) | | |

| Tricia Glynn | | 40 | | Managing Director of Advent International Corporation | | 2017 |

| | | | | | |

(1)Ms. Henry previously served Age as Chief Information Officer, Logistics & Distribution at lululemon from 2010 to 2014. In her role, Ms. Henry oversaw all global information and technology operations for the company. Prior to joining lululemon in 2010, Ms. Henry worked at Gap, Inc., where she served as Vice President and Chief Information Officer of International IT and Gap North America and was responsible for the systems support of key international growth initiatives. Ms. Henry was designated for appointment to our board of directors by Dennis J. Wilson in accordance with the terms of a support agreement between lululemon athletica, Mr. Wilson and certain entities affiliated with Advent International. Our board of directors believes that her strategic IT and retail experience as well as her experience with lululemon will provide valuable insight to our board of directors.April 1, 2021.

Jon McNeill

has been a member

Table of our board of directors since April 2016. Mr. McNeill has served as President, Global Sales, Delivery and Service of Tesla Motors, Inc., overseeing customer-facing operations, since September 2015. Prior to joining Tesla Motors, Inc., he was the CEO of Enservio, Inc., a software company, from 2006 until 2015, and founder of multiple technology and retail companies including TruMotion, Sterling, First Notice Systems, and Trek Bicycle Stores, Inc. Mr. McNeill began his career at Bain & Company. He is a graduate of Northwestern University. Our board of directors believes his executive experience and innovative and entrepreneurial attributes will provide valuable insight to our board of directors and is aligned with our unique culture.Contents

Class I Directors Continuing in Office until the 2017 Annual Meeting of Stockholders

Director Biographies

Michael Caseyhas been a member of our board of directors since October 2007 and began servingserved as Co-Chairmanco-chair of the Board inboard of directors from September 2014 to April 2017 and as chair of the board of directors from May 2014 to September 2014. He retired from Starbucks Corporation in October 2007, where he had served as Senior Vice Presidentsenior vice president and CFOchief financial officer from August 1995 to September 1997, and Executive Vice President, CFOexecutive vice president, chief financial officer and Chief Administrative Officerchief administrative officer from September 1997 to October 2007. Subsequent to retirement he served as a Senior Advisorsenior advisor to Starbucks Corporation from October 2007 to May 2008 and from November 2008 to January 2015. Prior to joining Starbucks, Mr. Casey was Executive Vice Presidentexecutive vice president and CFOchief financial officer for Family Restaurant,Restaurants, Inc. and Presidentpresident and CEOchief executive officer of El Torito Restaurants, Inc. He was also a member of the board of directors of The Nasdaq OMX Group, Inc. from January 2001 to May 2012. Mr. Casey graduated from Harvard College with an A.B. degree in Economics, cum laude, and Harvard Business School with an MBA degree.

Skills & Experience

•Our board of directors selected Mr. Casey to serve as director because he has extensive experience in corporate finance and accounting, managing retail-focused industry operations, strategic planning, and public company corporate governance. Our board of directors believes his service on executive, audit and compensation committees of other companies allows him to provide significant insight to our board of directors.

RoAnn CostinGlenn Murphy has been a member of our board of directors since March 2007. Ms. CostinApril 2017 and has served as non-executive chair of the Presidentboard of Wilderness Point Investments,directors since August 2018. He served as executive chair of the board of directors from February to August of 2018. He served as co-chair of the board of directors from April 2017 to November 2017 and as non-executive chair of the board of directors from November 2017 to February 2018. Mr. Murphy is an industry executive with more than 25 years of retail experience. He has successfully led diverse retail businesses and brands in the areas of food, health & beauty, apparel and books. He is the founder and CEO of FIS Holdings, a financialhigh-impact consumer-focused investment firm since 2005. From 1992deploying a combination of operating guidance and capital flexibility. He is also CEO and chairman of KKR Acquisition Holdings I, a blank cheque company targeting the consumer sector. Prior to FIS Holdings, Mr. Murphy served as chairman and chief executive officer at The Gap, Inc. from 2007 until 2005, Ms. Costin2014. Prior to that, Mr. Murphy served as the Presidentchairman and chief executive officer of Reservoir Capital Management,Shoppers Drug Mart Corporation from 2001 to 2007. Prior to leading Shoppers Drug Mart, he served as the chief executive officer and president for the Retail Division of Chapters Inc., an investment advisory firm. She co-founded Paola Quadretti Worldwide, Mr. Murphy started his career at Loblaws where he spent 14 years. He holds a women's made-to-measure clothing company and served on the boards of OLLY Shoes, a retailer of children's shoes and accessories, Alvin Valley Holdings, Inc., a retailer of designer women's clothing, and Toys R' Us. Ms. Costin received a B.A. in Government from Harvard University and an M.B.A.BA Degree from the Stanford University Graduate School of Business. Western Ontario.

Skills & Experience

•Our board of directors selected Ms. CostinMr. Murphy to serve as a director because she hasthey believe his extensive retail experience in corporate finance andas a leading strategic planning. Our board of directors believes her extensive management experience with respectoperator will provide valuable insight to both public and private companies allows her to provide our board of directors with significant insight on the retail industry.directors.

David M. Mussafer is lead director and has been a member of our board of directors since September 2014 and serves2014. Mr. Mussafer also served as co-Chairmana director of the Board.lululemon from 2005 until 2010. Mr. Mussafer is currently a Managing Partner atchairman and managing partner of Advent International Corporation ("Advent") and is responsible for Advent's North American private equity operations.which he joined in 1990. Prior to Advent, Mr. Mussafer joined Adventworked at Chemical Bank and Adler & Shaykin in 1990, has been a principal of the firm since 1993, and is a member of Advent's executive committee and board of directors.New York. Mr. Mussafer ishas led or co-led more than 25 buyout investments at Advent across a memberrange of the board of Five Below,industries. Mr. Mussafer’s current directorships also include Aimbridge Hospitality, First Watch Restaurants, Olaplex Inc., a publicly-traded specialty retailer of pre-teen and teen merchandise; Vantiv, Inc., a publicly-traded payment processing and technology solutions provider and several private companies.Thrasio. Mr. Mussafer holds a BSM, cum laude, from Tulane University and an MBA from the Wharton School of the University of Pennsylvania. Mr. Mussafer was appointed to the board of directors in connection with a support agreement which gives Advent a continuing right to nominate two designees to the board of directors and the opportunity to have one of its designees serve as a co-Chairman of the Board.

Skills & Experience

•Our board of directors believes hisMr. Mussafer's extensive experience enables him to provide valuable insights to the board of directors regarding board processes and operations as well as the relationship between the board of directors and stockholders.shareholders.

Laurent PotdevinKourtney Gibson was appointed as our Chief Executive Officer and a member of our board of directors in December 2013, and has served in those roles since January 2014. Mr. Potdevin previously worked at Toms Shoes, a socially-conscious shoe company, where he served as President from May 2011 to December 2013. From 1995 to 2010, he worked at Burton Snowboards, the world's largest and premier snowboarding company, serving in various capacities including as President and CEO from 2005 to 2010. Prior to joining Burton Snowboards, Mr. Potdevin worked at Louis Vuitton and LVMH. Mr. Potdevin received degrees from Ecole Superieure des Sciences Economiques et Commerciales, in France, and the Engineering School, Ecole Polytechnique Federale de Lausanne, in Switzerland. Our board of directors selected Mr. Potdevin because of his extensive experience at premium, technical athletic apparel and lifestyle-centric retail companies, and deep understanding of the importance of top-quality technical design, retail marketing strategies, and the power of building a strong brand.

Class II Directors Continuing in Office until the 2018 Annual Meeting of Stockholders

Steven J. Collins has been a member of our board of directors since September 2014. Mr. CollinsNovember 2020. Ms. Gibson is a Managing Directorpresident of Loop Capital Markets, an investment banking and brokerage firm, where she started as an intern 20 years ago. She is on the board of MarketAxess Holdings Inc. She also sits on the board of trustees at Advent International. Mr. Collins joined Advent in 1995the University of Miami and rejoined after graduate school in 2000. Mr. CollinsViterbo University as well as serves on the boards of the Dibia Dream Foundation and Chicago Scholars Foundation. Ms. Gibson is a member of the boardEconomic Club of directorsChicago and the Treasury Market Practices Group sponsored by the Federal Reserve Bank of Bojangles', Party City and Kirkland's, all of which are publicly traded, and Charlotte Russe, a privately-owned retailer of women's apparel. He was a member of the board of directors of Five Below Inc., a publicly-traded specialty retailer from 2010 until March 2015. Mr. CollinsNew York. Ms. Gibson received a BS from the Wharton School of the University of Pennsylvania and an MBA from Harvardthe Kellogg School of Business. Mr. Collins was appointed to the board of directors in connection with a support agreement which gives Advent a continuing right to nominate two designees to the board of directors and the opportunity to have one of its designees serve as a co-Chairman of the Board. Management at Northwestern University.

Skills & Experience

•Our board of directors believes hisselected Ms. Gibson to serve as a director because they believe her accomplishments as a business and finance leader provides experience enables him to provide valuable insights toin identifying opportunities for growing global consumer brands.

Calvin McDonald's biographical summary is included in the board of directors regarding management, accounting and financial matters as well as the relationship between the board of directors and stockholders."Executive Officers" section.

Martha A.M. (Marti) Morfitt has been a member of our board of directors since December 2008. She has served as a principal of River Rock Partners, Inc., a business and cultural transformation consulting firm, since 2008. Ms. Morfitt served as the CEOchief executive officer of Airborne, Inc. from October 2009 to March 2012. She served as the Presidentpresident and CEOchief executive officer of CNS, Inc., a manufacturer and marketer of consumer healthcare products, from 2001 through March 2007. From 1998 to 2001, she was Chief Operating Officerchief operating officer of CNS, Inc. Ms. Morfitt currently serves on the board of directors of Graco, Inc., a publicly-traded fluid handling systems and components company. She served on the board of directors of Mercer International Inc. from 2017 to 2020. She also served on the board of directors of Life Time Fitness, Inc., a publicly traded operator of fitness and athletic centers from 2008 to 2015. She received her HBA from the Richard Ivey School of Business at the University of Western Ontario, and an MBA from the Schulich School of Business at York University.

Skills & Experience

•Our board of directors selected Ms. Morfitt to serve as director because she has extensive public board experience and years of leading and managing branded consumer business operations and strategic planning.

Rhoda M. Pitcher has been a member of our board of directors since December 2005. Since 1996 she has served as Managing Partner of Rhoda M Pitcher Inc., a management consulting firm providing services in organizational strategy and the building of executive capability to Fortune 500 corporations, institutions, start-ups and non-profits. From 1978 to 1997, Ms. Pitcher co-founded, built and sold two international consulting firms. Ms. Pitcher holds a Master's degree in Organization Development from University Associates. Our board of directors selected Ms. Pitcher to serve as director because she has extensive experience in management consulting, culture development and strategic planning. Our board of directors believes her considerable knowledge of our business gained from more than 10 years as a director of lululemon makes her well suited to provide advice with respect to our strategic plans, culture and marketing programs.

Emily White has been a member of our board of directors since November 2011. She is the founder and CEOhas served as President of Anthos Capital, a mobile services start-up, Mave, Inc. SheLos Angeles-based investment firm since 2018. Prior to Anthos, Ms. White was the Chief Operating Officer ofchief operating officer at Snapchat, Inc., a photo messaging application from January 2014 to March of 2015. Prior to joining Snapchat, Ms. White washeld several leadership roles at Facebook Inc., a social networking company, from 2010 to 2013 where she held several key roles including Director of Local Business Operations, Director of Mobile Business Operations and DirectorHead of Business Operations at Instagram. From 2001 to 2010, Ms. White worked at Google where she ran North American Online Sales and Operations, Asia Pacific & Latin America business and the Emerging Business channel. She currently servesMs. White is also a board member and advisor to Graco, Inc. and is on the board of directors for Northern Start Investment Corp IV, a special purpose acquisition company, Railsbank, Olaplex, Inc. and Guayaki.

She has also served on the boards of the National Center for Women in IT,I.T., a non-profit coalition working to increase the participation of girls and women in computing and IT.technology, X-Prize, a non-profit focused on creating breakthroughs that pull the future forward. She received a BA in Art History from Vanderbilt University.

Skills & Experience

•Our board of directors selected Ms. White to serve as a director because of her extensive experience with social networking and technology companies, her understanding of the demographics in which our principal customers reside and the diversity in background and experience she provides to our board of directors.

Kathryn Henry has been a member of our board of directors since January 2016. Ms. Henry previously served as chief information officer, logistics & distribution at lululemon from 2010 to 2014 where she oversaw all global information and technology operations for the company. Since 2015, Ms. Henry has served as a strategic consultant for retail and technology companies, in addition to venture capital, investment and consulting firms seeking executive level guidance. Prior to joining lululemon in 2010, Ms. Henry worked at Gap, Inc., where she served as vice president and chief information officer of international IT and Gap North America and was responsible for the systems support of key international growth initiatives. Previously, she was vice president of Dockers Business Divestiture and vice president of global IT strategy & development at Levi Strauss & Co. Ms. Henry was selected as a Global CIO Top 25 Breakaway Leader in 2013, and was a member of the National Retail Federation CIO council during her tenure with lululemon.

Skills & Experience

• Our board of directors believes Ms. Henry's strategic IT and retail experience as well as her experience with lululemon provides valuable insight to our board of directors.

Jon McNeill has been a member of our board of directors since April 2016. Since January 2020, Mr. McNeill has served as chief executive officer of DVx Ventures. He previously served as chief operating officer of Lyft, Inc. from March 2018 to July 2019. From September 2015 to February 2018, he served as president, global sales, delivery and service of Tesla Inc., overseeing customer-facing operations. Prior to joining Tesla, Inc., he was the chief executive officer of Enservio, Inc., a software company, from 2006 until 2015, and founder of multiple technology and retail companies including TruMotion, Sterling, First Notice Systems, and Trek Bicycle Stores, Inc. Mr. McNeill began his career at Bain & Company. He is a graduate of Northwestern University.

Skills & Experience

•Our board of directors selected Mr. McNeill because they believe his executive experience and innovative and entrepreneurial attributes provide valuable insight and are aligned with our unique culture.

Stephanie Ferris has been a member of our board of directors since July 2019. From 2019 to 2020, Ms. Ferris was the chief operating officer of Fidelity National Information Services, Inc. From 2018 to 2019, she was the chief financial officer of Worldpay, Inc., a

payments technology company. Prior to becoming chief financial officer of Worldpay, Inc, in 2018, Ms. Ferris was the chief financial officer of Vantiv, Inc., a predecessor to Worldpay, since 2016 and its deputy chief financial officer since 2015. Ms. Ferris served in several capacities at Vantiv from 2010 to 2015. Earlier in her career, Ms. Ferris was employed in various positions of increasing responsibility of Fifth Third Bancorp, and began her career in public accounting at PricewaterhouseCoopers. Ms. Ferris is a Certified Public Accountant and a graduate of Miami University in Oxford, Ohio.

Skills & Experience

•Our board of directors selected Ms. Ferris to serve as a director given her broad experience and background in technology and finance.

Tricia Glynn has been a member of our board of directors since August 2017. Ms. Glynn has worked at Advent International since 2016 as a managing director focusing on buyouts and growth equity investments in the retail, consumer and leisure sector. Prior to Advent, Ms. Glynn spent 15 years investing across both Bain Capital Private Equity and the Private Equity Group of Goldman, Sachs & Co. She has closed transactions across the retail, healthcare, business services, real estate and media sectors, as well as internationally. From 2012 to 2018, Ms. Glynn served on the board of Burlington Stores Inc., a publicly traded department store retailer; and she is currently on the board of First Watch Restaurants Inc. and Olaplex, Inc. Ms. Glynn earned an A.B. in Biochemical Sciences cum laude from Harvard College and an MBA, with high distinction, as a Baker Scholar from Harvard Business School.

Skills & Experience

• Our board of directors believes Ms. Glynn's experience advising and investing in retail and consumer companies enables her to provide valuable and current insights to the board of directors.

Skills Matrix

Our directors have a diverse set of skills we believe are necessary to create an effective board. Listed below are qualifications and experiences we consider important to oversee the management of our business.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Qualifications & Experience |

Casey |

Ferris |

Gibson |

Glynn |

Henry |

McNeill |

Morfitt |

Murphy |

Mussafer |

White |

| Senior Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| International Markets | ü | ü | | | | ü | ü | ü | ü | |

| Finance/Accounting | ü | ü | ü | ü | | ü | ü | ü | ü | ü |

| Public Company Board Service | ü | ü | | ü | ü | ü | ü | ü | ü | ü |

| Retail Industry | ü | | ü | ü | ü | ü | ü | ü | ü | |

| Digital/Technology | | ü | | | ü | ü | | | | ü |

| Strategy | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| HR & Talent | | | | | | | ü | ü | | ü |

Environmental, Social & Governance (ESG) | ü | | | | ü | ü | ü | ü | | |

Independence of the Board

PursuantThe U.S. federal securities laws pertaining to corporate governance of publicly-traded companies and the Nasdaq listing standards require the board of directors to make an evaluation and determination as to the listing standardsindependence of The Nasdaq Stock Market, or Nasdaq, a majoritymembers of the board of directors in accordance with the standards provided in U.S. federal law and the Nasdaq listing standards. The board of directors has reviewed the general definitions and criteria for determining the independence of directors, information provided by each director, other relevant facts and circumstances bearing on each director's ability to exercise independent judgment in carrying out the responsibilities of a director, any arrangements or understandings between any director and another person under which that director was selected as a director, and the recommendations of the corporate responsibility, sustainability and governance committee regarding the independence of our current directors. Based on this review, our board of directors has determined that the following current members of our board of directors must qualifyare "independent" for the purposes of the Nasdaq listing standards as "independent" within the meaning of Nasdaq Rule 5605, as affirmatively determined by our board of directors. they relate to directors:

| | | | | | | | |

| Michael Casey | Tricia Glynn | Martha Morfitt |

| Stephanie Ferris | Kathryn Henry | David Mussafer |

| Kourtney Gibson | Jon McNeill | Emily White |

Our board of directors consults with our outside legal counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of "independent," including those set forth in the Nasdaq listing standards in effect at the time of the determination.

Consistent with these considerations, after review of all relevant transactions or relationships between each director and director nominee, or any of his or her family members, and lululemon, our senior management and our independent auditors, our board of directors has affirmatively determined that the following 10 directors and director nominees are independent directors within the meaning of the applicable Nasdaq listing standards: Robert Bensoussan, Michael Casey, Steven J. Collins, RoAnn Costin, William H. Glenn, Jon McNeill, Martha A.M. Morfitt, David M. Mussafer, Rhoda M. Pitcher, and Emily White. In making this determination,Calvin McDonald, our board of directors found that none of these directors and director nominees had a material or other disqualifying relationship with the company. Laurent Potdevin, our Chief Executive Officer,chief executive officer, is not an independent director by virtue of his current employment with lululemon, and Kathryn Henrythat Glenn Murphy, our non-executive chair of the board of directors (and former executive chair), is not an independent director by virtue of her past employment with lululemon.his service as executive chair of the board of directors for part of 2018.

Executive Sessions

Non-management directors generally meet in an executive session without management present each time our board of directors holds its regularly scheduled meetings.

Committees and Meeting Attendance

Our board of directors has three standing committees, including an Audit Committee, a Compensation Committee,audit; people, culture and a Nominatingcompensation; and Governance Committee.corporate responsibility, sustainability and governance committees. Each of these committees operates under a written charter adopted by our board of directors. Copies of these charters are available on our website at www.lululemon.com.